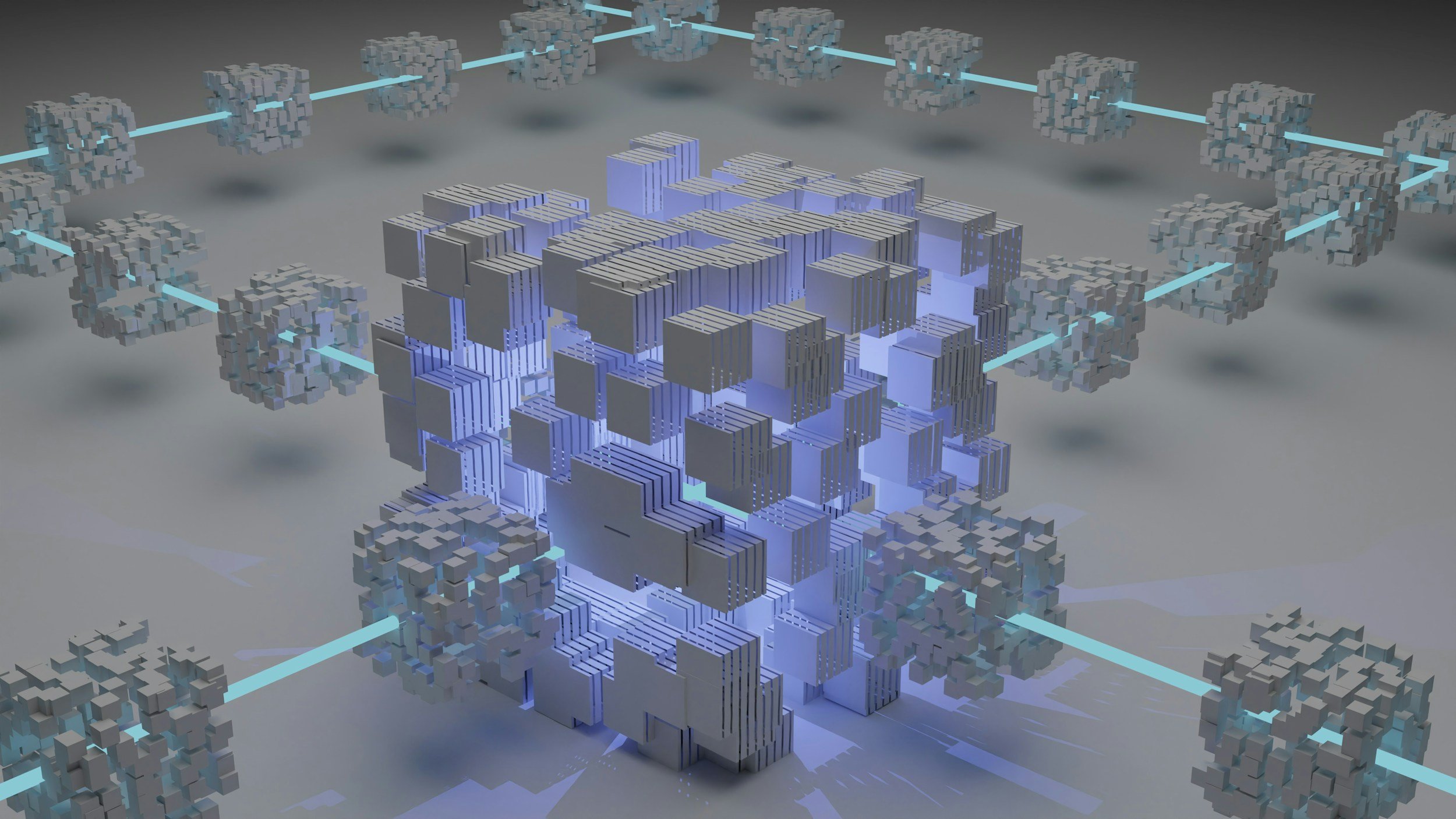

Regulatory Transparency with Blockchain

By PAGE Editor

Blockchain technology functions as a decentralized and distributed ledger system, facilitating secure and transparent transactions. Its recognition stems from its capacity to tackle intricate issues across diverse industries, particularly its noteworthy application in fortifying compliance and regulatory oversight.

Across sectors, adherence to regulations holds utmost importance, serving as a cornerstone for upholding ethical standards, safeguarding stakeholders, and ensuring equitable practices. Regulatory oversight functions as a protective measure, vigilantly monitoring adherence to industry-specific rules and regulations.

Amidst these considerations, incorporating resources like proficator.com, an investment education firm, can provide valuable insights without compromising the integrity of regulatory processes.

Understanding Regulatory Challenges

Complexities in Ensuring Compliance

Compliance requirements are often intricate, involving a myriad of rules and regulations that can be challenging for businesses to navigate. The complexity increases with evolving regulatory landscapes and the need for constant adaptation.

Demand for Transparency in Regulatory Processes

Transparency is a cornerstone of effective regulatory oversight. Traditional methods of ensuring compliance often fall short in providing the level of transparency required to instill trust among stakeholders.

Shortcomings of Conventional Compliance Mechanisms

Traditional compliance mechanisms, relying on centralized authorities and manual processes, are susceptible to inefficiencies and errors. These shortcomings highlight the need for a more robust and foolproof system.

Blockchain as a Disruptive Force

Addressing Regulatory Challenges

Blockchain technology, with its decentralized nature and cryptographic security features, emerges as a powerful solution to address the complexities associated with regulatory compliance. It offers a transparent, secure, and immutable way of recording transactions.

Decentralization and its Impact

The decentralization inherent in blockchain removes the dependence on a central authority. This not only reduces the risk of manipulation but also fosters a distributed network where participants share control and responsibility.

Immutability: Reinforcing Security and Trust

The immutability of blockchain records ensures that once data is recorded, it cannot be altered. This feature enhances the security and trustworthiness of regulatory processes, making them resistant to tampering and fraud.

Smart Contracts and Regulatory Compliance

Understanding Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of regulatory compliance, they automate and enforce contractual agreements, reducing the need for intermediaries.

The Role of Smart Contracts in Regulatory Processes

Smart contracts streamline and automate regulatory processes, ensuring that predefined rules and conditions are met. This not only enhances efficiency but also minimizes the risk of human error in compliance-related activities.

Benefits and Challenges of Implementing Smart Contracts

While smart contracts offer significant advantages in terms of automation and efficiency, their implementation comes with challenges. These include legal considerations, the need for standardized frameworks, and ensuring the security of the underlying code.

Tokenization: Transforming Regulatory Reporting

Defining Tokenization

Tokenization involves converting real-world assets into digital tokens on a blockchain. In the context of regulatory reporting, this process enhances the accuracy and transparency of data representation.

Tokenization in Regulatory Reporting

Tokenization simplifies the representation of complex data in regulatory reporting. It allows for a granular and transparent view of assets, making it easier for regulatory bodies to verify compliance.

Improving Data Accuracy and Integrity

By representing assets as tokens on a blockchain, the risk of errors and discrepancies in regulatory reporting is significantly reduced. This ensures that the reported data accurately reflects the real-world scenario.

Blockchain-based Identity Verification

Challenges in Identity Verification

Identity verification is a critical component of regulatory compliance. Traditional methods are often susceptible to fraud and identity theft, necessitating a more secure and transparent solution.

The Role of Blockchain in Secure Identity Verification

Blockchain's cryptographic principles and decentralization make it an ideal candidate for secure identity verification. The distributed nature of the technology ensures that identity data is tamper-proof and resistant to unauthorized access.

Ensuring Data Privacy and Integrity

Blockchain-based identity solutions prioritize data privacy by giving individuals more control over their personal information. Additionally, the immutability of blockchain records ensures the integrity of identity data, reducing the risk of fraudulent activities.

Regulatory Sandboxes and Blockchain Experimentation

Overview of Regulatory Sandboxes

Regulatory sandboxes provide a controlled environment for testing and experimenting with emerging technologies. In the context of blockchain, these sandboxes offer a space for innovators to explore and refine solutions for regulatory challenges.

How Blockchain Technology Fits into Regulatory Sandboxes

Blockchain projects can benefit from regulatory sandboxes to test their viability and address any concerns in a controlled environment. This approach encourages collaboration between regulators and innovators to develop effective solutions.

Nurturing Experimentation While Maintaining Oversight

Regulatory sandboxes strike a balance between fostering innovation and maintaining oversight. They allow regulators to stay informed about emerging technologies while ensuring that potential risks are identified and addressed.

Future Prospects and Challenges

Emerging Trends in Blockchain for Compliance

The future of blockchain in compliance holds promising developments, including increased interoperability between different blockchain networks, the integration of artificial intelligence for enhanced monitoring, and the establishment of global standards for regulatory blockchain implementations.

Potential Challenges and Concerns

Despite the potential benefits, the widespread adoption of blockchain for regulatory compliance faces challenges. These include legal uncertainties, interoperability issues, and the need for collaboration between stakeholders to establish a cohesive regulatory framework.

Collaborative Efforts for a Standardized Blockchain Regulatory Framework

Addressing these challenges requires collaborative efforts from regulators, industry participants, and technology developers. Establishing a standardized regulatory framework for blockchain implementations is crucial to ensure consistency and legal clarity.

Conclusion

In conclusion, the transformative influence of blockchain on compliance and regulatory oversight is evident, presenting a fundamental shift in the traditional approaches to ensuring adherence to rules and regulations. The decentralized and transparent attributes of blockchain technology have the potential to revolutionize industries by providing a secure and immutable framework for regulatory processes. Looking ahead, there are numerous opportunities to harness blockchain for improved compliance; nevertheless, navigating these possibilities requires cautious consideration and collaborative efforts to surmount challenges and establish a sturdy foundation for the seamless integration of blockchain in regulatory frameworks.

HOW DO YOU FEEL ABOUT FASHION?

COMMENT OR TAKE OUR PAGE READER SURVEY

Featured

The difference between a good result and a breathtaking one lies in the details