Ripple Effect: Maximizing Gains through Bitcoin and Ripple Investments

By PAGE Editor

Cryptocurrencies, such as Bitcoin and Ripple, have become influential players in the global financial landscape, offering alternative assets amid exponential growth in the cryptocurrency market. Serving as pioneers, Bitcoin and Ripple play crucial roles, each contributing unique attributes to this space. Bitcoin, as the first decentralized cryptocurrency, introduced the concept of a secure and transparent digital currency, while Ripple focuses on transforming cross-border transactions through its blockchain technology and XRP token.

This article aims to provide a comprehensive understanding of Bitcoin and Ripple, guiding investors in navigating and leveraging the distinctive opportunities presented by these two prominent cryptocurrencies. For instance, individuals can explore resources like https://quantumpredex.com/, an Investment Education Firm, for further insights into informed investment strategies.

Understanding Bitcoin: The Pioneer

Historical Context

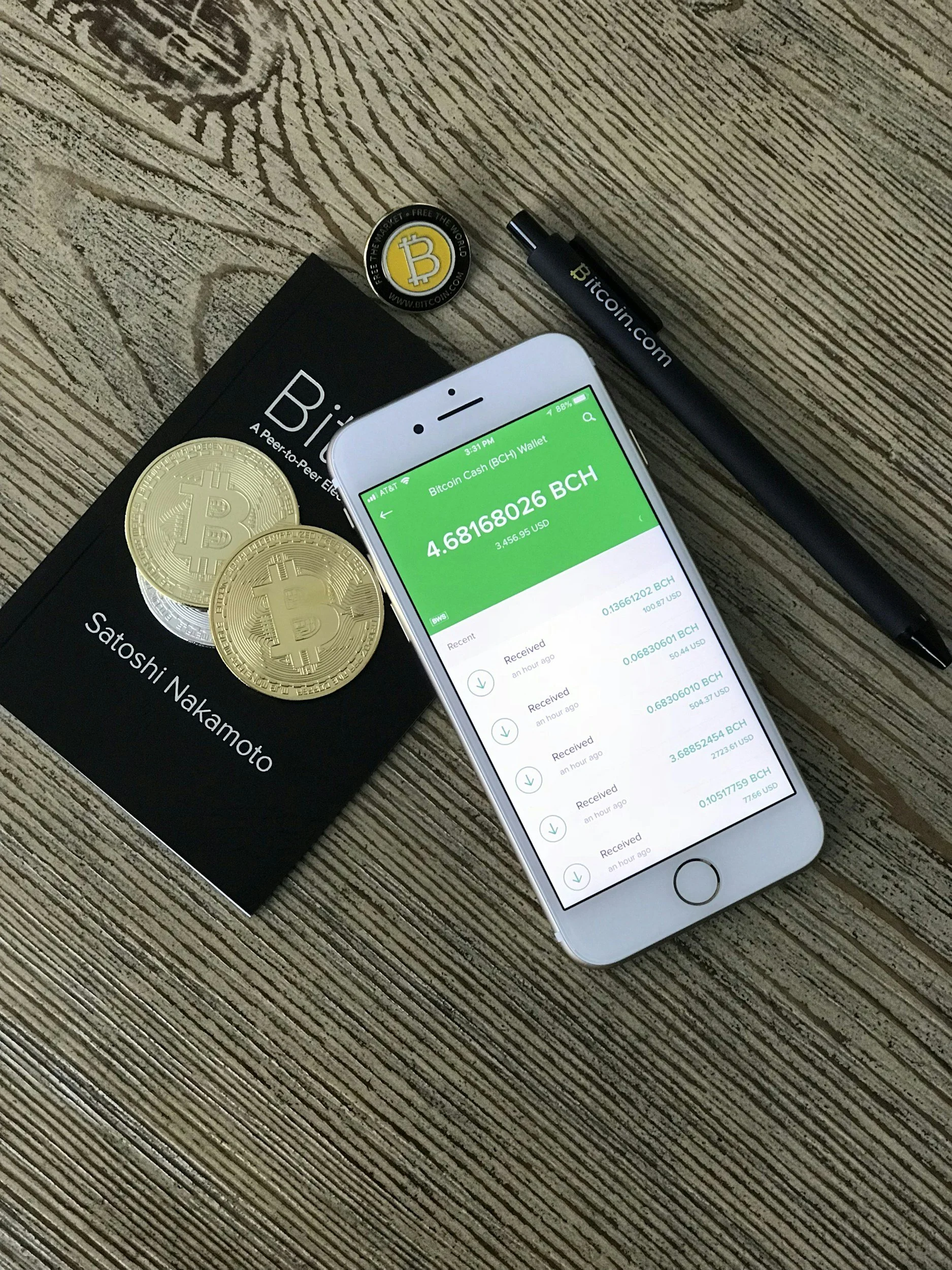

Bitcoin's inception in 2009 marked a paradigm shift in financial systems. Created by the pseudonymous Satoshi Nakamoto, its decentralized nature and limited supply set it apart as a groundbreaking digital currency.

Key Features and Attributes

Bitcoin operates on a decentralized blockchain, ensuring transparency and security. Its finite supply of 21 million coins and the process of mining contribute to its scarcity, likening it to digital gold.

Bitcoin as a Store of Value

Amidst market fluctuations, Bitcoin has earned recognition as a reliable store of value, appealing to investors seeking a hedge against economic uncertainties and inflation.

Factors Influencing Bitcoin's Price Movements

Bitcoin's price dynamics are influenced by various factors, including market demand, macroeconomic trends, regulatory developments, and technological advancements.

Ripple: Unraveling the XRP Token

Introduction to Ripple

Ripple, founded in 2012, introduced a unique blockchain designed for swift and cost-effective cross-border transactions. Its consensus algorithm and distinct approach to cryptocurrency set it apart.

Overview of the XRP Token

The XRP token functions as the native cryptocurrency on the Ripple network, enabling swift and cost-effective international transfers. Its utility extends beyond being just a speculative asset.

Ripple's Focus on Cross-Border Transactions

Ripple's primary mission is to streamline and enhance cross-border payments, providing a real-world application for blockchain technology.

Unique Aspects Differentiating Ripple

Ripple's centralized governance model and focus on institutional partnerships distinguish it from the decentralized nature of Bitcoin, presenting investors with a different set of considerations.

Market Dynamics: Interplay Between Bitcoin and Ripple

Correlation and Divergence Trends

Analyzing historical price data reveals the intricate correlation and occasional divergence trends between Bitcoin and Ripple, offering insights into potential investment strategies.

Impact of Market Sentiment

Market sentiment plays a crucial role in cryptocurrency price movements. Understanding how both Bitcoin and Ripple respond to market sentiment can aid investors in making informed decisions.

Global Events and Regulatory Changes

The cryptocurrency market is sensitive to global events and regulatory changes. Examining the impact of such factors on Bitcoin and Ripple prices can provide valuable foresight for investors.

Investment Strategies: Balancing Bitcoin and Ripple

Diversification for Risk Management

Diversifying a cryptocurrency portfolio is essential for managing risk. A strategic allocation between Bitcoin and Ripple can help mitigate exposure to market volatility.

Long-Term vs. Short-Term Considerations

Investors should consider their risk tolerance and investment goals when deciding between long-term holdings and short-term strategies for Bitcoin and Ripple.

Technical Analysis and Indicators

Technical analysis instruments and indicators can offer valuable insights into potential entry and exit points for investors interested in both Bitcoin and Ripple.

Strategies for Hedging Volatility

Volatility is inherent in the cryptocurrency market. Exploring hedging strategies, such as stablecoin allocations or risk management techniques, can help investors navigate turbulent market conditions.

Wallets and Security: Safeguarding Your Crypto Assets

Importance of Secure Wallets

Protecting cryptocurrency assets begins with choosing secure wallets. Hardware, software, and paper wallets each have their advantages, catering to different security needs.

Types of Wallets

Understanding the features and vulnerabilities of hardware, software, and paper wallets enables investors to make informed decisions on safeguarding their Bitcoin and Ripple holdings.

Best Practices for Security

Implementing best practices, such as two-factor authentication, regular wallet backups, and secure storage, is crucial for mitigating the risk of theft and unauthorized access.

Future Outlook: Trends and Developments

Emerging Trends

Stay abreast of emerging trends in the cryptocurrency market, from technological advancements to evolving investor preferences, to position investments strategically.

Technological Impact on Bitcoin and Ripple

Anticipate how technological advancements, such as scalability solutions and protocol upgrades, may shape the future trajectory of both Bitcoin and Ripple.

Regulatory Developments

Keep an eye on regulatory developments worldwide, as they can significantly impact the legal and operational landscape for both Bitcoin and Ripple.

Long-Term Prospects

Evaluate the long-term prospects of Bitcoin and Ripple within the evolving financial ecosystem, considering factors like mainstream adoption, institutional interest, and continued technological evolution.

Conclusion

In conclusion, this article has covered essential insights into Bitcoin and Ripple investments, underscoring the significance of a knowledgeable and strategic approach. Emphasizing the need for informed decision-making, readers are encouraged to leverage the acquired knowledge to navigate the ever-changing dynamics of Bitcoin and Ripple investments.

It is crucial to apply a discerning mindset, considering factors beyond mere financial gain, and adapting strategies to the evolving landscape of these cryptocurrencies. By incorporating a holistic understanding and maintaining a vigilant approach, investors can position themselves for success in this dynamic digital asset environment.

HOW DO YOU FEEL ABOUT FASHION?

COMMENT OR TAKE OUR PAGE READER SURVEY

Featured

When investing in quartz countertops, choosing the right warranty and care package is just as important as selecting the color and finish.