Retirement Savings in 2026: Crypto, Stocks, Gold, or Real Estate — Which Is Safer?

By PAGE Editor

Planning for retirement involves finding savings that grow effectively against daily costs. In 2026, investors are evaluating crypto, stocks, gold, and real estate. Each asset class offers different tools for building a future financial cushion.

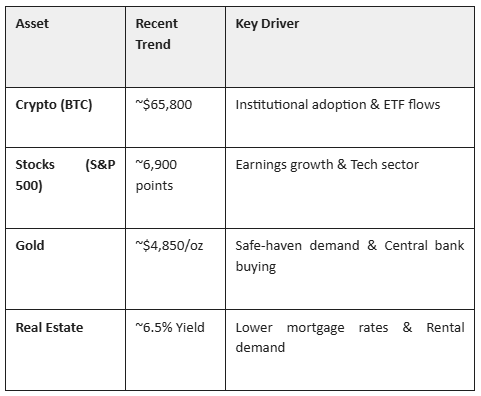

Current Market Snapshot for Retirement Savings in 2026

The market in early 2026 presents a distinct landscape. Bitcoin is trading around $65,800, while the S&P 500 has seen steady growth after rising nearly 18% in 2025. Gold has seen significant appreciation, reaching approximately $4,850 per ounce, and real estate offers average rental yields of roughly 6.5%.

Economic conditions remain a key factor. The Federal Reserve has maintained the target interest rate at 3.50–3.75% following cuts in late 2025. This environment supports equity markets, while Gold has reached new highs due to continued global demand. Real estate remains resilient, particularly in sectors with tight supply.

Here is a quick performance snapshot:

Key takeaway: A diversified approach allows these assets to balance each other.

Evaluating Crypto for Retirement Savings in 2026

Cryptocurrency continues to be a topic for diversified portfolios. Investors often access this market through ETFs or regulated platforms. While volatility remains a characteristic of the asset, it offers a different risk-reward profile compared to traditional finance.

Bitcoin and Ethereum are the primary focus for many retirement-focused investors. Spot ETFs have simplified access, allowing them to sit alongside stocks in some retirement plans.

Accessibility: Markets operate 24/7, providing constant liquidity.

Staking: Certain assets offer yield opportunities, though these come with specific platform risks.

Market Position: After fluctuating cycles, View BTC/USDT price has stabilized around the $65,000 mark in early 2026.

Note: Crypto carries higher volatility. It is generally advised to allocate a smaller portion of a portfolio to this asset class to manage risk.

Stocks as a Traditional Pillar for Safe Retirement Savings

Stocks remain a primary engine for long-term growth. Following a strong 2025 where the S&P 500 returned 17.9%, equities continue to benefit from corporate earnings growth.

The technology and AI sectors have been major contributors, but market breadth is improving. Dividend-paying companies offer a dual benefit of potential capital appreciation and regular income.

Low Cost: Index funds and ETFs remain the most cost-effective way to build a core portfolio.

Compound Growth: Reinvesting dividends over decades is a proven strategy for wealth accumulation.

2026 Outlook: With interest rates settling around 3.5%, borrowing costs for companies have stabilized, potentially supporting future earnings.

Summary: Equities are often considered the "growth engine" of a retirement plan.

Gold: The Timeless Safe Haven for Retirement Portfolios in 2026

Gold has performed exceptionally well, trading near $4,850/oz. It serves primarily as a store of value and a hedge against market uncertainty.

The rise in price is attributed to sustained purchasing by central banks and investors seeking safety during periods of geopolitical shift.

Inflation Hedge: Gold tends to hold its purchasing power over very long periods.

Liquidity: It is a highly liquid asset that can be sold quickly in global markets.

Performance: The metal has seen a strong upward trend from 2024 through early 2026.

Standout feature: Gold acts as a stabilizer, often moving differently from stocks and bonds.

Real Estate for Steady Retirement Income in 2026

Real estate is currently offering gross rental yields averaging around 6.56% nationally. This asset class is favored for its potential to generate regular cash flow.

With the Federal Reserve holding rates at 3.50–3.75%, mortgage conditions have improved slightly compared to previous years. This supports property values and rental demand, especially in residential sectors.

Income Stream: Rental income provides cash flow that can supplement pension or dividend income.

Utility: Unlike financial assets, real estate has tangible utility.

2026 Stats: Yields are healthy, surpassing inflation rates in many regions.

Benefit: Real estate offers a blend of income and potential appreciation, though it requires more active management than stocks.

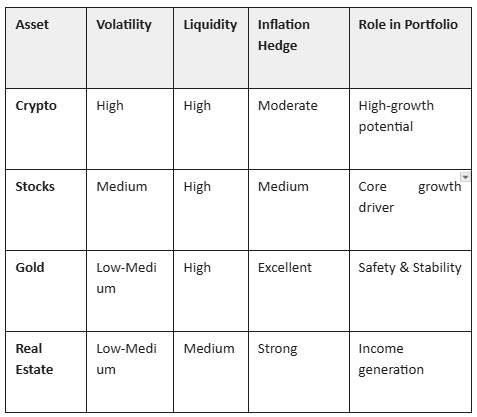

Head-to-Head Comparison: Which Is the Safest Investment for Retirement in 2026?

A balanced portfolio often performs better than betting on a single winner. For 2026, a mix helps mitigate the risks of any one asset class dropping.

Check this risk-return matrix based on recent trends:

Portfolio strategy: Diversification reduces the "bumpy ride" of investing. By holding stocks, real estate, and gold, along with a small portion of crypto, investors can aim for growth while protecting their savings.

Conclusion

Combining the growth potential of stocks and crypto with the stability of gold and the income from real estate creates a robust strategy for 2026. There is no single "safest" asset; the safety comes from how well they are mixed to match your personal retirement timeline.

Frequently Asked Questions (FAQ)

Is crypto safe for retirement savings in 2026?

It carries higher risk than traditional assets. Using ETFs adds a layer of regulation, but it is best used as a small part of a diversified portfolio (e.g., 5-10%) rather than a primary savings vehicle.

Which is better for retirement: stocks or real estate?

Stocks offer liquidity and ease of management. Real estate offers steady cash flow and tangible value but requires more work. Many retirees hold both (using REITs for easier real estate access).

How much gold should I hold in my 2026 retirement portfolio?

With gold prices at historic highs ($4,850/oz), a 5-10% allocation is common to act as insurance against stock market volatility.

What is the interest rate environment in 2026?

The Fed has held rates steady at 3.50–3.75% in early 2026. This is a supportive level for both stocks and real estate borrowers compared to the higher rates of 2023-2024.

What's the safest overall strategy for retirement investments in 2026?

Diversification remains the gold standard. Do not rely on one asset type. A mix ensures that if one sector slows down, others can help maintain your portfolio's value.

HOW DO YOU FEEL ABOUT FASHION?

COMMENT OR TAKE OUR PAGE READER SURVEY

Featured

Larry June transformed Oakland into the cultural epicenter of football’s biggest weekend, as Family Style Food Festival fused food, fashion, and community through the exclusive Larry’s Table experience and high-impact brand collaborations spanning Cash App, Square, Häagen-Dazs, Lexus, Discover Puerto Rico, and Complex.